On October 2, 2013, the federal court approved a settlement agreement in the Betty Johnson case.

U.S. District Court for the NMI designated Judge Frances Tydingco-Gatewood declared, “It’s over. It’s all over.”

This proclamation followed the perusal of the draft final order endorsing the settlement agreement.

The agreement states that commencing with the October 15 (2013) payroll, pension annuitants will experience a 25 percent reduction in benefits. “The District Court finds that the settlement is fair, reasonable, and adequate, and in the best interests of the plaintiff and all class members,” stated Judge Tydingco-Gatewood while reading the order.

Plaintiff Betty Johnson, acknowledged as the class representative and recipient of a $7,500 service award, expressed gratitude to the court, attorneys, Governor Inos, and all involved parties via teleconference.

Reflecting on the four-year legal journey, Johnson characterized it as a monumental day for the CNMI, expressing appreciation for the unwavering support of retirees throughout the litigation process.

As early as September 25, the court signaled a favorable stance towards the settlement agreement, appointing Civille & Tang PLLC as Settlement Trustee, with Attorney Joyce C.H. Tang as its principal representative.

“It’s an extraordinary, unprecedented event,” remarked Settlement Trustee Tang during a court session. Post-hearing, Tang extended acknowledgment to Governor Eloy S. Inos, plaintiffs, Judge Tydingco-Gatewood, U.S. Judge Robert J. Faris, and others involved in the exhaustive process. She underscored the commitment to work closely with the Inos administration and the Legislature to implement the settlement terms, assuring accessibility and a seamless transition of Fund employees to the Settlement Fund.

Assistant Attorney General Reena Patel welcomed the outcome, emphasizing the required compromises during the settlement agreement negotiations. Plaintiff counsel Margery Bronster, elated with the final approval, considered it a triumph. The court not only sanctioned the settlement agreement but also endorsed the $779 million consent judgment in the event of government default.

Bronster highlighted the government’s obligations, emphasizing adherence to the settlement terms to avoid consent judgment enforcement. She expressed satisfaction with the level of protection for retirees, disregarding community concerns about attorney fees’ impact on the settlement outcome.

With the settlement agreement’s final approval, the Retirement Fund’s assets transition to the Settlement Fund, rendering the pending motions in the Betty Johnson case moot. The court certified the settlement class, incorporating members of the Defined Benefit Plan as of August 6, 2013, or those entitled to survivor’s benefits.

The final judgment enumerated conditions supporting class action, paving the way for the assignment and transfer of all CNMI Retirement Fund assets to the Settlement Fund.

Seamless Transition to Settlement Fund

The court emphasized that the settlement agreement’s final approval ensures a seamless shift from the Retirement Fund to the Settlement Fund. Trustee Joyce C.H. Tang confirmed the commencement of the transition process, promising updates on Fund asset transfers during the first status hearing in November.

Earlier indications suggested a $113 million asset transfer from the Fund to the Settlement Fund. Trustee ad litem Joseph C. Razzano disclosed disbursement details, including $9.7 million in P.L. 17-82 mandated refunds to Fund members who terminated their membership.

Remaining Refunds and Future Payouts

The settlement agreement not only secures ongoing pensions for retirees but also promises hope for active members awaiting contributions refunds. With legislative approval, the Fund plans to distribute the remaining $44,613,950.13 in P.L. 17-82 refunds.

A significant victory for retirees, the settlement agreement addresses concerns about pensions and outlines measures to ensure government compliance. The comprehensive agreement, coupled with judicial oversight, provides a framework for continued stability in pension payouts.

Final Approval and Future Prospects

Plaintiff counsel Margery Bronster sought final approval of the class-action settlement and certification of the class, highlighting the meticulous adherence to certification requirements. Notices were sent to class members, resulting in minimal opt-outs, affirming strong class participation.

Bronster emphasized the settlement’s benefits, including the transfer of assets to the Settlement Fund and the minimum 75 percent payment commitment. The agreement includes provisions for increased payments and a $779 million consent judgment in case of government default.

The court concurred with the approval, recognizing the settlement’s merits and the potential consequences of protracted litigation on retirees’ benefits.

In conclusion, the final approval of the settlement agreement marks a pivotal moment for retirees, ensuring continued pension stability and addressing concerns of active members awaiting refunds. The court’s oversight, coupled with the comprehensive terms of the agreement, establishes a framework for sustained financial security for all involved parties.

The case

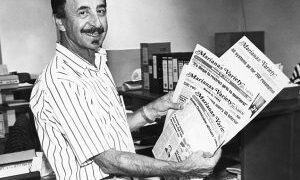

Retiree and plaintiff Betty Johnson sued the CNMI government on behalf of the retirees in the Northern Marianas, alleging that the government failed in paying the required amounts by law to the pension fund and consequently would lead to the fund running out of money by 2014.

![An 1899 Puck Magazine cartoon shows Uncle Sam lecturing four children labelled Philippines (who appears similar to Philippine leader Emilio Aguinaldo), Hawaii, Porto[sic] Rico and Cuba in front of children holding books labelled with various U.S. states. In the background are an American Indian holding a book upside down, a Chinese boy at the door and a black boy cleaning a window.](https://houseoftaga.com/wp-content/uploads/2024/02/School_Begins_Puck_Magazine_1-25-1899-360x180.jpg)

![An 1899 Puck Magazine cartoon shows Uncle Sam lecturing four children labelled Philippines (who appears similar to Philippine leader Emilio Aguinaldo), Hawaii, Porto[sic] Rico and Cuba in front of children holding books labelled with various U.S. states. In the background are an American Indian holding a book upside down, a Chinese boy at the door and a black boy cleaning a window.](https://houseoftaga.com/wp-content/uploads/2024/02/School_Begins_Puck_Magazine_1-25-1899-75x75.jpg)

Discussion about this post